Globalization plays a significant function worldwide of audit. It is a very considerable subject due to the fact that as globalization comes to be more and more important, it changes which accountancy concepts one would certainly utilize when particular situations arise.

There are 2 collections of bookkeeping principles: the Usually Accepted Audit Principles (GAAP) and also the International Financial Coverage Requirements (IFRS).

The Generally Accepted Accountancy Concepts are generally utilized within businesses in the USA, while the International Financial Coverage Requirements are utilized in the majority of worldwide firms.

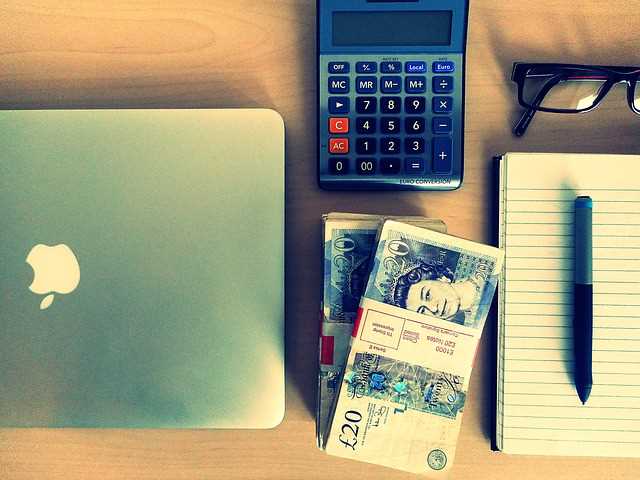

The fact that there are 2 sets of requirements or concepts that can be used in the bookkeeping world ensures situations challenging. For instance, when freedom capitalists are selecting a business to buy, they need to utilize their economic information to inform themselves as well as make details decisions.

However, this is occasionally made difficult due to the fact that if one company utilizes IFRS and an additional utilizes GAAP, it’s testing to develop a proper comparison across both concepts. This is constantly coming to be an increasing number of a relevant problem as business remain to broaden their markets around the world.

Without view of an universal system being taken into location soon, accountants are required to increase their knowledge of both forms of accountancy principles.

A couple of years earlier, there were very few worldwide accounting training courses used at universities. Now, there are enough for it to be considered its very own major.

In today’s world, where all globe economies straight influence each other, U.S. accountants should utilize worldwide methods along with techniques in the USA to effectively conduct service.

Take for instance a scenario positioned in a write-up created by Paul E. Holt who is an audit teacher at Texas A&M. In Dr. Holt’s instance, he specifies:

What if you get something that requires repayment in an international currency or market something for which you will receive foreign money?

You are immediately challenged with a variety of brand-new problems that you do not have to deal with in residential bookkeeping. What if the exchange price in between the UNITED STATE dollar as well as the international money changes in between the day you videotape an accounts payable and also the date you in fact make settlement in international money?

There would certainly be either a gain or loss from the currency exchange rate variation. (Holt). This is just an example of the many circumstances that could emerge within the world of global accountancy.

There are many various other instances in the locations of tax obligation, as well as audit, which has drastic effect directly pertaining to the economic status of a company. These brand-new problems as well as circumstances are compelling accountants to increase their expertise as well as create new understandings of global company.

One favorable end result of this facet is the reality that it also creates even more tasks within the accounting area such as worldwide accounting professionals.

The location of global audit supplies many opportunities for those that desire to increase their understanding, skills as well as capabilities to fit the globe of international service. It may require the understanding of new languages or continuous traveling, one can find unlimited chances in the accountancy globe for global accountants that are very looked for after.

Globalization has substantial impacts upon the accounting world. New and emerging technologies are making it easier for all services to increase internationally.

As companies are increasing globally, accounting professionals have to prepare as well as adjust for worldwide accounting. Without a global audit standard to adhere to, the world of accountancy is substantially influenced. Every part of accounting is affected as businesses are relocated worldwide.

In addition to that, the knowledge that accountants are anticipated to have increases every day as a result of the development of worldwide business. Consequently, if globalization and also companies continue to increase, the world of bookkeeping will certainly continue to grow as well as develop.