Financial Spread betting likewise called Financial Spread Trading has seen enormous development over the last years in the UK and also is a flexible and tax-efficient way to back anything from shares, currencies, assets, Bonds, supply indices, and also even home rates.

Financial spread wagering lets you gain exposure to the efficiency of vital markets, without having to set up the amount of the transaction as you’re trading on margin.

So you can make money from market relocations while just putting forward a margin down payment as security, this can be as reduced as 10% of the contract value.

As your transaction is a bet, your revenues are devoid of UK resources gains tax obligation and also revenue tax, as well as trades on private shares are without stamp responsibility. Those outside the UK may also be able to Spread Wager nonetheless the same tax benefits do not use.

One of the significant benefits of financial spread wagering over conventional share trading is that it is just as very easy to go short as it is to go long. That is, you can make money even when a particular market is falling, you merely open a SELL/DOWN bet rather than a BUY/UP wager. Various other approaches of shorting shares are commonly pricey and also not conveniently offered to smaller private traders.

Financial Spread wagering can be made use of to trade from less than one min up to one year and can be made use of to cover a series of various financial investment techniques. As an example, you might utilize spread bets to hedge the worth of your existing holdings, Hedge against a currency exchange movement, or hypothesize on market volatility. You additionally have the adaptability to react promptly to any kind of adjustments in market conditions as the majority of Monetary Spread Betting companies are open 24-hour a day.

As the popularity of Financial Spread Betting has grown so has the variety of Financial Spread Betting Brokers, as traders, this is great information as the competition has actually caused much better products, lower spreads as well as smaller-sized bets dimensions.

An additional benefit is the ability to trade in your base money for example sterling, even though the market may be selling US Buck for instance Gold or Oil, this indicates you do not need to bother with exchange rates. To view this article in its original blog setting, along with company website articles, visit their page for further info.

An instance of a Financial Spread Bet Gold

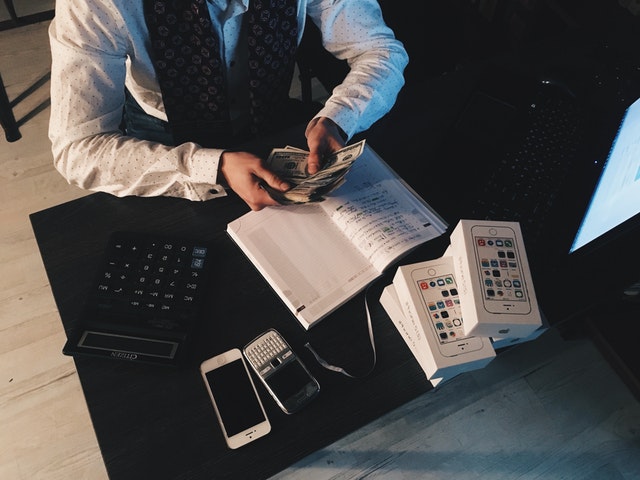

Let’s consider placing a trade on Gold. We can trade using a phone, Net, as well as numerous situations now we, can trade with a mobile phone such as an iPhone.

All spread wagers have an expiry date; we don’t need to hold the bet till this date.

In this case, April Gold which is presently quoted at 945.0/ 946.0 The very first cost is the price we cost the second is the price we purchase. We think Gold will increase so we purchase ₤ 100 per factor at 946.0.

One vital factor in trading is to constantly shield your drawback; nevertheless, certain you are required to have a safety net, in this instance a Guaranteed Stop loss. We will position our quit 20 factors away, so if Gold hits $926 after that the bet will certainly be immediately closed out. This suggests that our downside is known in advance, our revenue is unrestricted yet our threat is purely restricted to 20 X ₤ 100 so ₤ 2,000.